It is not uncommon for corporations to own stock in other corporations. The ownership could be either through acquisitions or the creation of a new corporation by the parent company. Sometimes, for a variety of reasons, the parent company wants to separate their ownership in the subsidiary corporation, most of the time it’s because the subsidiary is in an unrelated business from the parent or has more growth prospects as a separate company. That separation from the parent corporation can be either through a spin-off, split-off, split-up, carve-out, or simply a sale of the subsidiary. This article will focus on the first three and briefly discuss a carve-out; a sale of a corporation is straightforward and will not be covered.

Spin-Off

First let’s define what is a corporate spin-off; a spin-off is when a new company is created from the subsidiary or division of an existing (parent) company. The parent company creates a completely separate entity and issues new shares of the new entity to its existing shareholders. One of the most prominent recent examples, was the spin-off of PayPal (PYPL) from its former parent EBay (EBAY) on July 17, 2015. In that case, EBay shareholders received one share of PayPal for each share of EBay they owned. EBay recognized the growth potential of PayPal as an independent company and made the following announcement “each [company will] have a sharper focus and greater flexibility to pursue future success in their respective global commerce and payments markets.” In a spin-off, existing shareholders do not give up or exchange any of their existing shares in the parent company. They essentially receive shares of the new company on a pro-rata basis; this pro-rata allocation also allows for a non-taxable event (see below for tax implications).

Split-Off

Again, let’s define what is a corporate split-off; a split-off is when a new entity is created from the parent company and shareholders of the parent company exchange their shares for the newly created entity. One notable example is the split-off of Synchrony Financial (SYF) from its parent General Electric (GE) on November 17, 2015. Synchrony Financial was a wholly owned subsidiary of General Electric, but then CEO Jeffrey Immelt decided to separate its financial business from its core industrial business. In that announcement, GE offered its existing shareholders the opportunity to exchange each share of GE stock for 1.0505 shares of newly formed Synchrony stock. The key words here are opportunity and exchange; as you can see, the main difference between a spin-off and a split-off is that in a split-off, shareholders must exchange their existing shares for the new company whereas in a spin-off, the existing shareholders are given shares in the new company. Also, shareholders of the parent company are not required to exchange their shares; they have the opportunity to do so and can choose to keep their existing shares of the parent company. Lastly, don’t assume the spin-off is better because the shareholder is given shares versus having to exchange their existing shares; in a spin-off, the price of the shares of the parent corporation decline by the market value of the spun off corporation.

Split-Up

In the previous two examples, the parent company either gives shares of a new company to existing shareholders or allows existing shareholders to exchange their shares for the new company. In both instances, the parent company survives as a standalone company. In a split-up, the parent company is split into two or more entities, but the parent company is liquidated and does not survive. The largest most recent example is the announcement by United Technologies on November 26, 2018 to split-up into three separate companies: United Technologies, Otis Elevator Company, and Carrier. While the United Technologies name will remain the same for one of the three companies, the new company (UTC) will be an entirely new entity from its original parent (UTX).

Carve-Out

Another corporate action is a carve-out which is essentially when a parent company creates a new corporation and sells shares of that new corporation through an IPO (Initial Public Offering). No shares are given to or exchanged with existing shareholders. In 2009, Las Vegas Sands did a carve-out of its Sands China subsidiary into a new entity to raise over $3 billion in cash. According to Deloitte Corporate Finance, 64 percent of companies engage in carve outs because they need cash or capital. The number one reason is because the entity is “not considered core to the [parent] company’s business strategy.”

Taxation

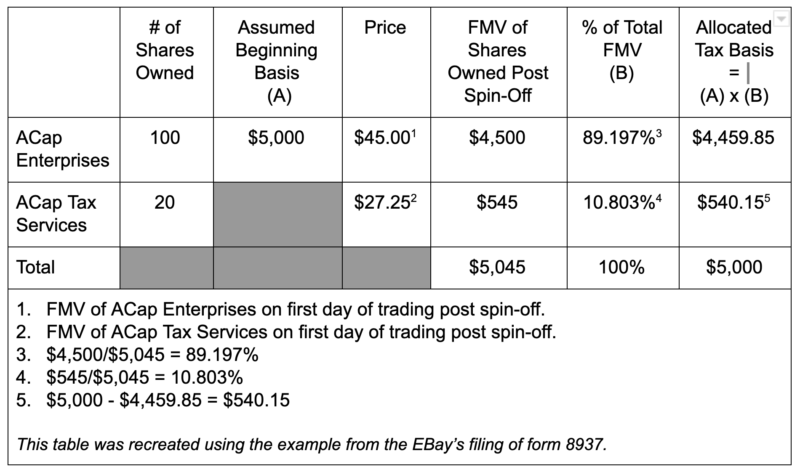

As with any corporate action, it is important to understand the tax implications, especially cost-basis which is the key variable when calculating capital gains taxes. The taxation of spin-offs, split-offs, and split-ups is governed by Internal Revenue Code 355 (IRC 355). Generally speaking, such events are not taxable when they occur if the company follows certain rules, which are beyond the scope of this article. The most important question to ask is what is my cost basis after a spin-off, split-off, or split-up? Below is a simple fictitious example to help understand how to calculate the cost basis after a corporate reorganization assuming a one-time purchase of 100 shares in ACap Enterprises (AE) for $5,000 and the subsequent spin-off of ACap Tax Services (ATS) where AE shareholders are given 1 share of ATS for each share of AE they own.

The examples above assume simple reorganizations with whole shares, but often times fractional shares are involved, cash in lieu of fractional shares, dividends are reinvested, stock splits occur, and shares purchased over a period of time all result in differing cost basis. As a result, capital gain taxes become very complicated. If you own stock in any company, you will at some point experience a corporate reorganization. While you may ignore the proxy materials mailed to you to vote on the matter, the end result will still affect how much you pay in taxes so it is imperative to keep meticulous records.

ACap can help you decide which of these options is best for your corporation. To find out more, please contact us to schedule a free consultation.

Ara Oghoorian, CFA, CFP®, CPA is the President & Founder of ACap Advisors & Accountants.

ACap Advisors & Accountant is a “Fee-Only” wealth management and full-service accounting firm headquartered in Los Angeles, specializing in helping doctors and healthcare professionals make sound financial decisions.