http://www.bloomberg.com/news/articles/2016-08-31/the-labor-day-guide-to-putting-your-money-to-work

Retailers use Labor Day to sell us “elegant” fire pits and pom-poms for handbags (yes, an accessory for an accessory). That isn’t quite what the holiday is about. It’s about work.1

So instead of adding to debt or dipping into savings to jump on those doorbusters, you can get a great long-term deal by making your job and the benefits that come with it—including your paycheck—work harder for you.

Here’s how to make sure you’re getting the maximum payoff from your employer.

Whack those fees, raise that bar

Very few of us are saving enough for retirement. One example: Members of Gen X, which covers those born between 1965 and 1978, are saving a median of 7 percent of their salary in a workplace retirement plan, according to Transamerica’s recent survey of retirement readiness by generation. Even if that 7 percent comes with a decent company match—and one of the first rules of personal finance is to get that free money—it’s far from the 15 percent of salary many experts recommend saving. A 2015 report by Financial Engines (PDF) estimated that employees may leave $24 billion on the table by not getting the full company match.

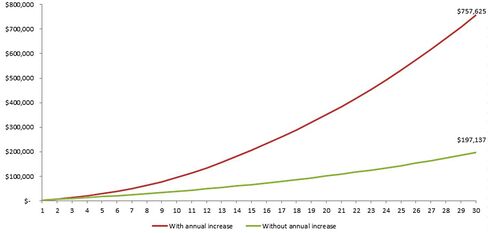

If you are getting the full match, try to bump savings up by 1 percentage point a year (and, if you hit the contribution limit on your 401(k), do it in an outside account). It can make a big difference over time, as this chart from Vanguard shows. The scenario looks at the impact of increasing 401(k) contributions by 1 percentage point annually over 30 years and is based on initially deferring 3 percent of a $100,000 salary.

Another way to improve long-term returns is to make sure you’re not paying too much in fees. “Most clients know about their 401(k) plan” because they’re “eager to find ways to minimize paying taxes,” said certified financial planner Matthew Crisafulli of Acap Asset Management. But they don’t know about the fees, he said.

A recent spate of lawsuits against 401(k) plan sponsors has alleged fiduciary breaches of duty at plans in which participants were offered higher-priced retail mutual fund share classes rather than lower-cost share classes available to plans with significant assets.

If a mutual fund you own has the share class meant for smaller investors—you can check the expense ratio on your plan’s web site and compare it with fees listed on a fund family’s site or Morningstar.com—you might consider moving to a low-cost index fund in your plan that follows a similar investing strategy.2 You could find you’re in an actively managed mutual fund with fees 10 times those of a low-cost index fund, for example, and without better long-term performance.

A quick way to get a sense of whether you’re paying a lot more than you need to is to use a service called feeX, which compares the fees on the options in your plan with fees for options available at other providers. This could be a way to handle a 401(k) rollover.

Save—or save more of—your pay automatically

Direct deposit of a paycheck is arguably one of the great conveniences of our time. And it’s as easy to have money zapped over into other dedicated savings accounts as it is to have it zapped to your bank. You can choose to have it done without even setting an amount if you use a service like Digit, which uses an algorithm to get a sense of your spending patterns and then spirits away amounts to a savings account when it judges you won’t miss it. (You set some parameters around how much.)

Aside from making savings mindless, you can make it fun, or use it to reward or punish your own behavior. Qapital is an online savings tool that can work with “if this, then that” (IFTTT) rules for when money is sent to a savings account. One of the most popular rules is the freelancer rule, says founder George Friedman. That automatically sets aside a third of any payments that come in for taxes. You can also set up rules to reward yourself with savings when you resist making an impulse buy (you’re impulse saving now), reward yourself for getting enough sleep, or set up a rule to add to your Paris savings fund if the weather’s nice there.

Or you could set up a rule to reward yourself every time you make a step toward making your money work harder for you (reading this article counts). You could also reward yourself for every one of these seven rules of effective investing that you already do. Not doing any of them yet? Well, you have many rewards to look forward to.

Take advantage of tax-advantaged deals

A solid way to get more mileage out of your money is to use a flexible spending account (FSA) or a dependent-care FSA if your employer offers one. You sign up to have a certain amount of money—for individuals, $2,550 was the cap in 2016; for a dependent-care FSA, it was $5,000—taken from your paycheck. It is deposited, pre-tax, into an FSA. If you’re in the 25 percent tax bracket, and enroll for $5,000 in a dependent-care FSA (which can be used for child care or elder care), that’s basically $1,250 more to spend on qualified health care costs.

“We continually see clients overlooking flex spending accounts for health care or child care,” said Jeffrey Nauta, of Henrickson Nauta Wealth Advisors. “If someone’s in a 25 percent marginal tax bracket, it’s like a 25-percent-off sale on health care and child care.”

Health savings accounts (HSAs) are another benefit that financial planners love, and say their clients don’t always take advantage of. If you have a high-deductible savings plan, odds are you have an HSA, which your employer might even contribute to. These accounts are “triple tax-advantaged,” meaning that contributions come out of paychecks pre-tax, funds in the HSA can be invested to grow tax-free, and, if used for qualifying medical expenses, HSA money can be distributed tax-free as well. After age 65, distributions can be taken from the HSA for any reason without penalty—you’ll just owe tax on the amount.

And finally…

Sometimes the best way to get the most out of your job really has nothing to do with money. “Instead of stressing about your morning coffee costs, think about whether you’re in a job that has the growth potential you’re looking for,” said Ethan Bloch, Digit’s chief executive officer. “Consider your happiness, figure out what gives you meaning, and then decide what you really want to do with your life. That’s the most valuable thing you can spend your energy on.”